If insurance terms and definitions confuse you, you’re not alone. A 2016 survey found that only 4% of Americans could identify basic insurance terms and definitions. In order to better understand dental benefits, it’s important to start with the basics. That’s why we’re breaking down commonly confused dental definitions–plain and simple.

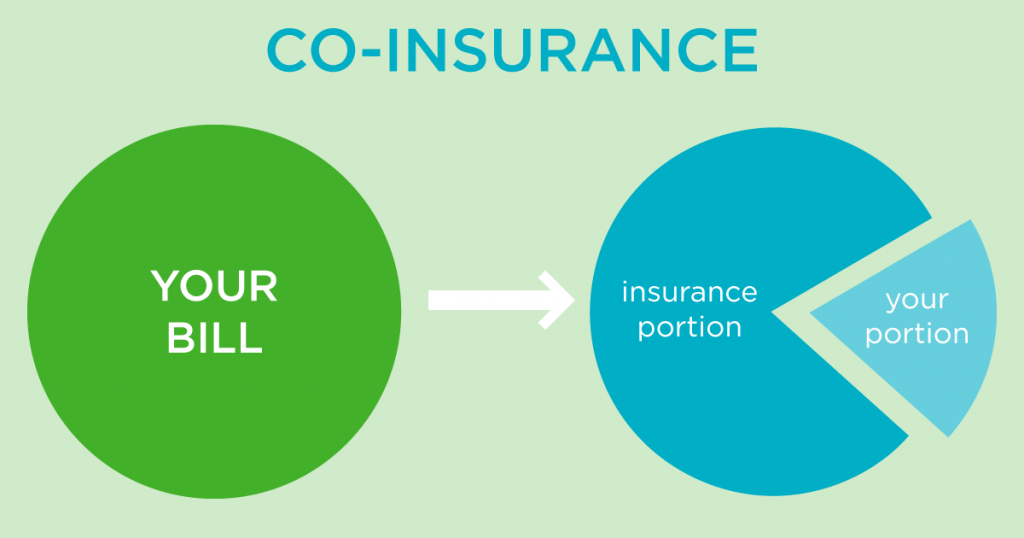

COINSURANCE

Coinsurance is the percentage you would pay for a dental procedure. Delta Dental of Idaho will pay a percentage, and the patient will pay a percentage as well. For example, if you have a filling and the percentage is 80% for Delta Dental of Idaho, your percentage would be 20%.

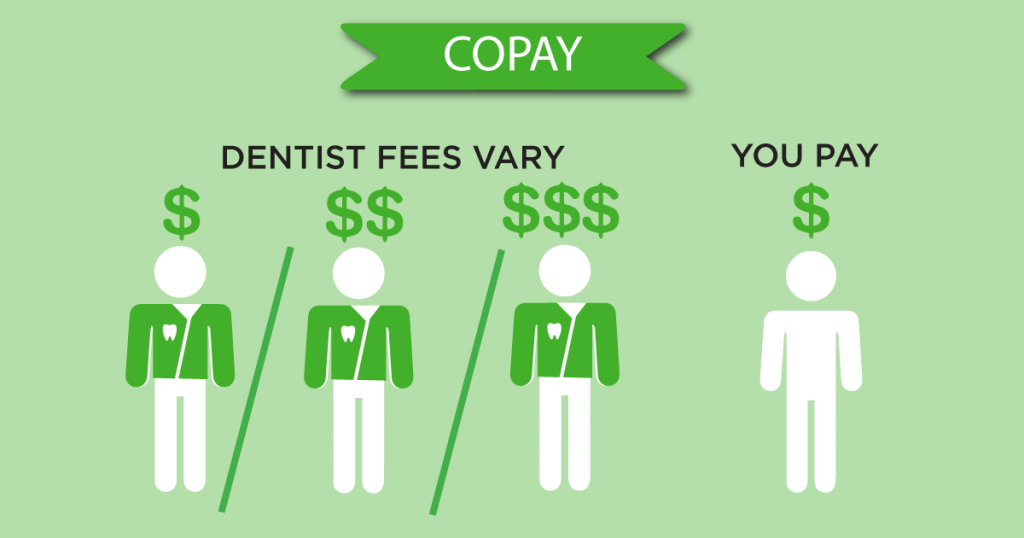

CO-PAY

A co-pay is a cost-of-sharing arrangement in which you pay a specific charge at the time of service ($15 for a routine dental check-up, for example).

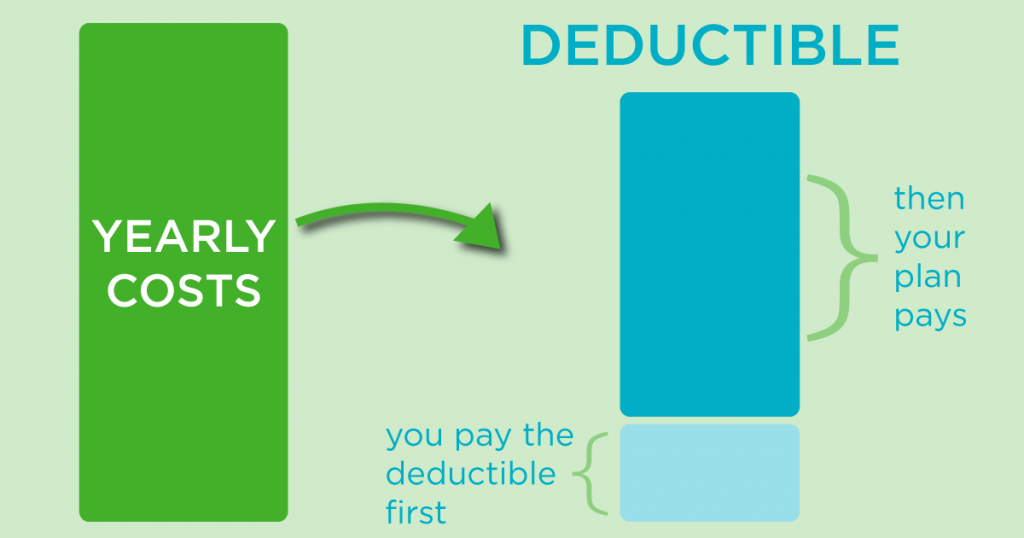

DEDUCTIBLE

A deductible is a specific dollar amount you pay before the dental coverage provider pays their portion. Deductibles usually apply to basic or major treatment, not cleanings and exams. Be sure to check your benefits.

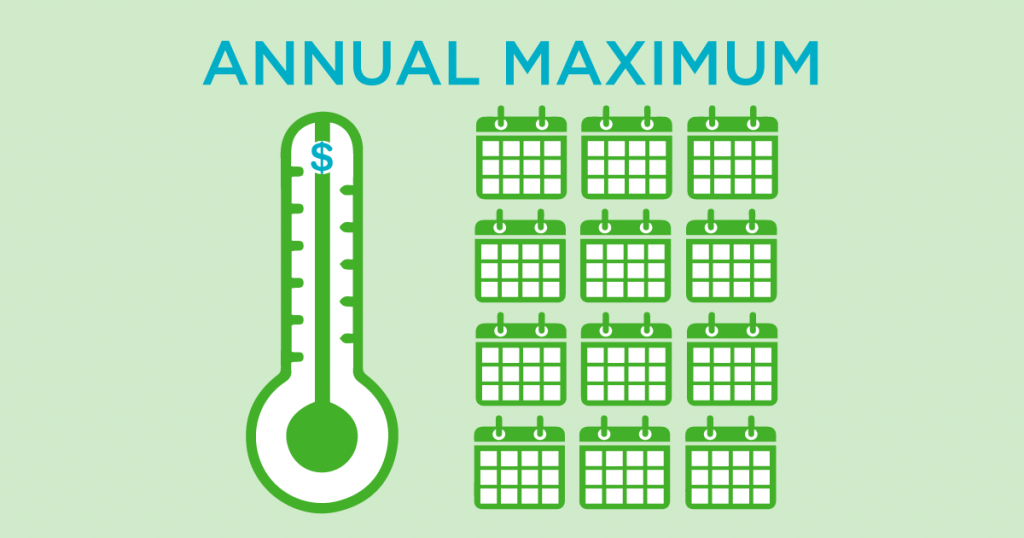

ANNUAL MAXIMUM

An annual maximum is the maximum dollar amount a dental benefit plan will pay toward the cost of dental care within a specific period, usually a calendar year. If your plan’s annual maximum is $1,000, your dental benefits company will pay its portion of your bill up to that amount for any covered dental services received in that year. After that annual maximum amount, it’s your responsibility to pay for any additional costs until your plan year starts over.

PREMIUM

Typically a monthly charge, a premium is the total amount paid to the dental provider for your coverage. Your employer pays the premium in whole or in part.

Still feel bad about your lack of insurance knowledge?

Check out our Insurance 101 and Insurance 102 infographics.